Junio, which was founded by former Paytm executives, handled 200,000 transactions worth Rs. 10 crores in October alone.

Satya Siba Nayak, 15, uses a debit card to subscribe to YouTube Premium and Netflix, as well as to download applications from Google Play and pay for items when out with friends. By downloading the FamPay app, Nayak gained access to his own card for making online and offline payments.

“My father does not reside with us since he works in Karnataka, and my mother was unfamiliar with Google Pay and other similar services, so I was looking for a way to conduct cashless transactions,” the class 10 student said.

According to Nayak and other young Indians, receiving monetary handouts from their parents is neither convenient nor often realistic. Prepaid wallets were indeed a popular choice for many parents as a way to offer their children greater independence while still enabling them to establish limitations.

Now, a new generation of fintech firms is developing full-fledged debit schemes for minors and processing crores of dollars in monthly transactions. However, as the volume and value of interactions on these platforms expand, the emergence of apps as a primary source of income for children raises issues.

The Ultimate Client

Prior to using FamPay, Nayak conducted transactions with the cash he received from his father in the form of pocket money. He also commonly utilized his parents’ debit cards to make internet purchases. However, the convenience of obtaining his own card has raised Nayak’s monthly expenditure to Rs. 2,500 (online and offline).

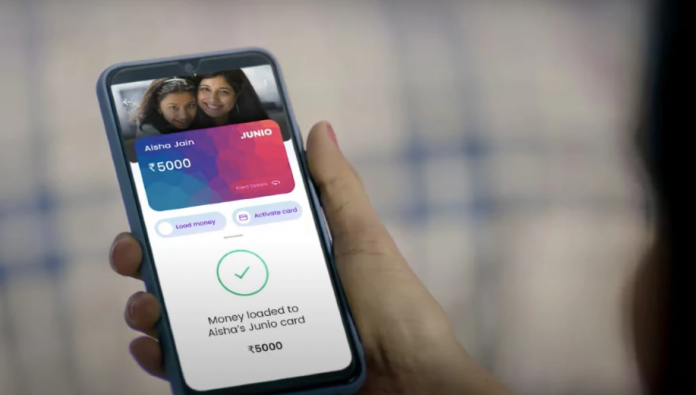

FamPay is one of many prominent new-age banking applications (often referred to as neobanks) in India that cater to children and teenagers. Junio, which was started in May by former Paytm executives, and Walrus, which was founded in 2019, is also popular in this category.

Additionally, the applications require a fee for registration. FamPay charges an introductory fee of Rs. 299 for its standard card and Rs. 599 for its premium card. The primary distinction is in the form of incentives and tie-ins such as Zomato Pro, as well as the card’s customization.

Junio, on the other hand, charges a flat Rs. 99 registration cost. Additionally, the website notes that in exchange for the subscription cost, consumers get a lucky dip with a reward value of up to Rs.1,000. Additionally, these applications enable parents to monitor their children’s spending habits through specialized analytics and dashboards. Simultaneously, parents may halt all transactions or get alerts for each new payment their children make using the app.

While applications such as FamPay and Junio are intended to serve as a platform for teens, they do not want to stay a solution for their clients until they become adults. These new players want to establish themselves as the one-stop banking solution for these teenagers after they reach the end of their adolescent years.

“If we create a bank account and are satisfied with it, we do not change,” stated Shankar Nath, Junio’s Co-Founder. “So, we want to be that, and we’re focusing on capturing youngsters between the ages of 12 and 13 and developing relationships with them via our app.”