The three major risks after you retire are – Longevity Risk, Lifestyle Risk and Health Coverage Risk.

Anup Bansal, Chief Investment Officer, Scripbox explains, “Longevity risk is that one outlives his/her corpus, lifestyle risk is that one has to compromise on one’s lifestyle after retirement and health coverage risk is that one’s corpus and health insurance are inadequate in supporting medical expenses due to health issues.”

Therefore, according to experts you need to address and plan for these risks, to have a stress free retirement.

Here are some actions that you can take towards retirement planning;

- You may not have given a thought to your life goals and things that you would like to do once you have more time at hand. “Understanding the purpose of money, life goals and planning for them will keep one energized and motivated during one’s sunset years,” says Bansal.

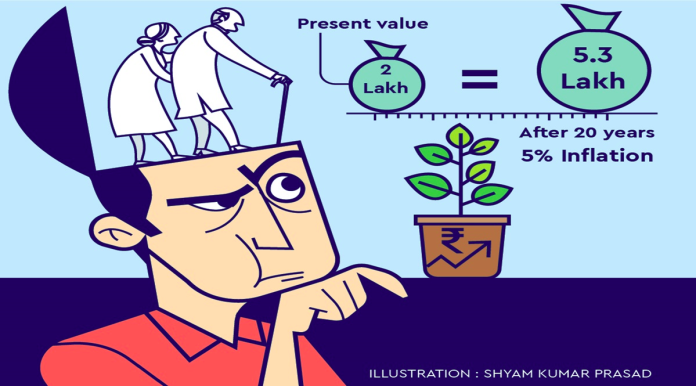

- Review your current expenses and needs at the time of your retirement factoring in inflation and your lifestyle. Some of the expenses may not be incurred after retirement like kids’ education but some other expenses like life goals planning, healthcare may be additional.

- Experts believe the expenses exercise should be conducted at least once a year and course corrections should be made based on the latest available data.

- Plan your investment portfolio taking into account the retirement corpus requirement, financial goals until the time of retirement, income growth, savings rate and other parameters.

- You should review your portfolio and asset allocation at least once a year and make changes based on how the progress has been against your retirement plan.

- Take adequate health cover for you and your partner (assuming kids will have their own health cover once they turn into adults) for healthcare-related expenses after retirement.

According to experts, you should work with a qualified and experienced financial advisor to plan your retirement and track your progress against it.